Secure

now your

Just.me name

Get easy and instant

your own

Just.me Page

with all your links

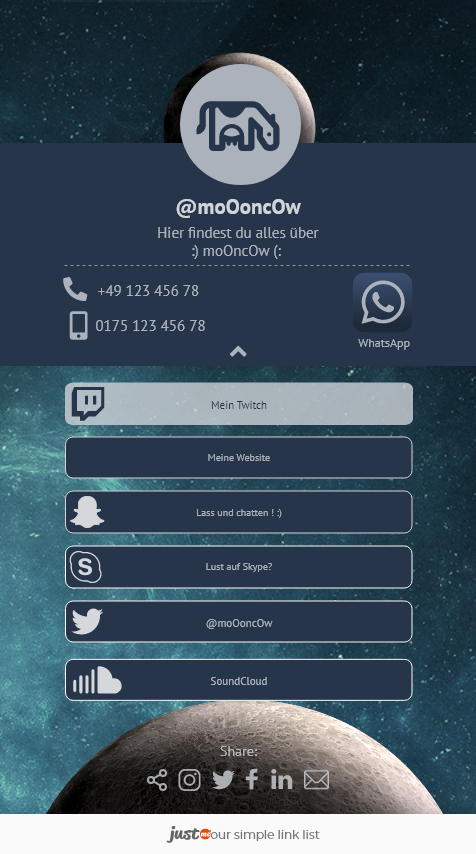

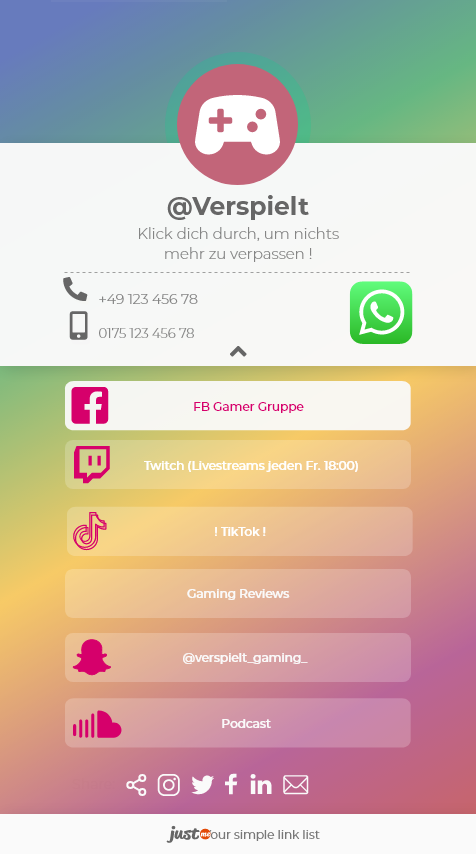

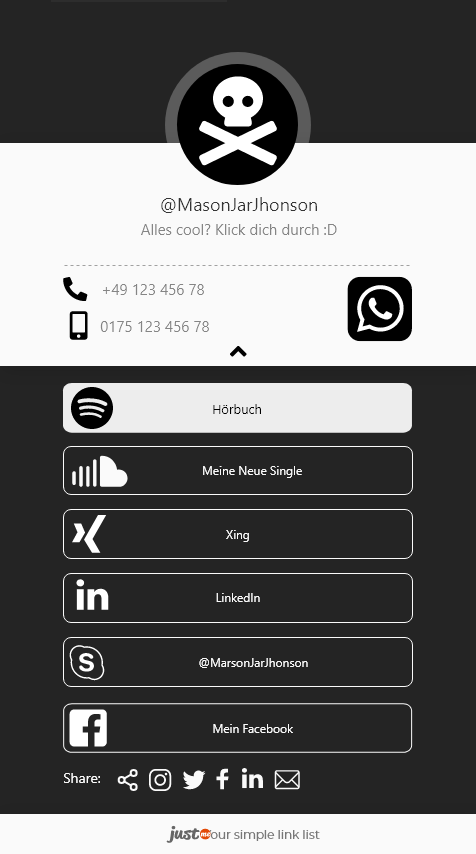

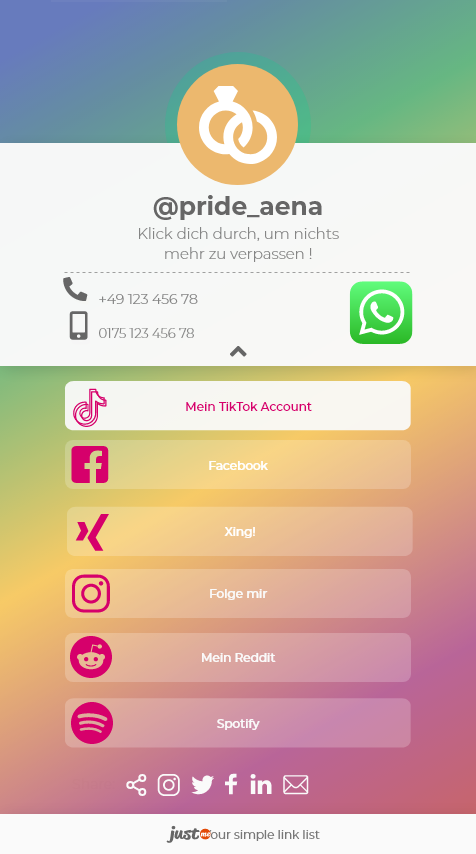

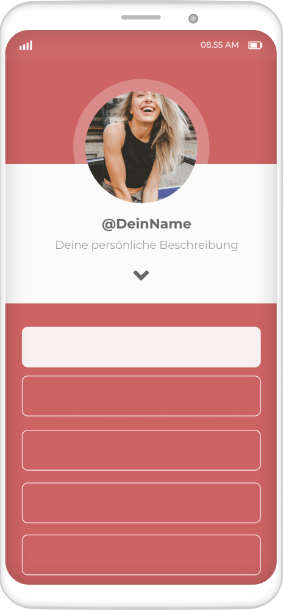

Your link list

for all platforms

Never send multiple links to your friends again, use your Just.me Page to show all your important links. Keep your friends up2date with just.me.

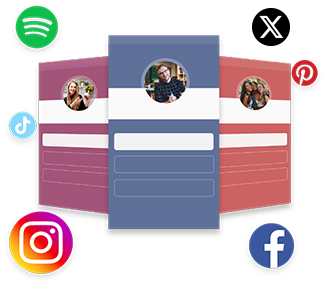

Features

4 free

You also get advanced features like priority links, themes and analytics 4 free. Find out how often your site is visited, how often people click on which link and where your visitors come from.🚀

Your Just.me -

Your style

You are unique, your Justme page can be too! Give your link list a facelift thanks to innovative themes that fit you, your personality or your business 🦄